Intrinsicly evisculate emerging cutting edge scenarios redefine future-proof e-markets demand line

Gallery Posts

Working Hours

| Mone - Fri: | 09:00 - 06:00 |

|---|---|

| Saturday: | 09:00 - 12:00 |

| Sunnday | 09:00 - 04:00 |

| Monday | 09:00 - 05:00 |

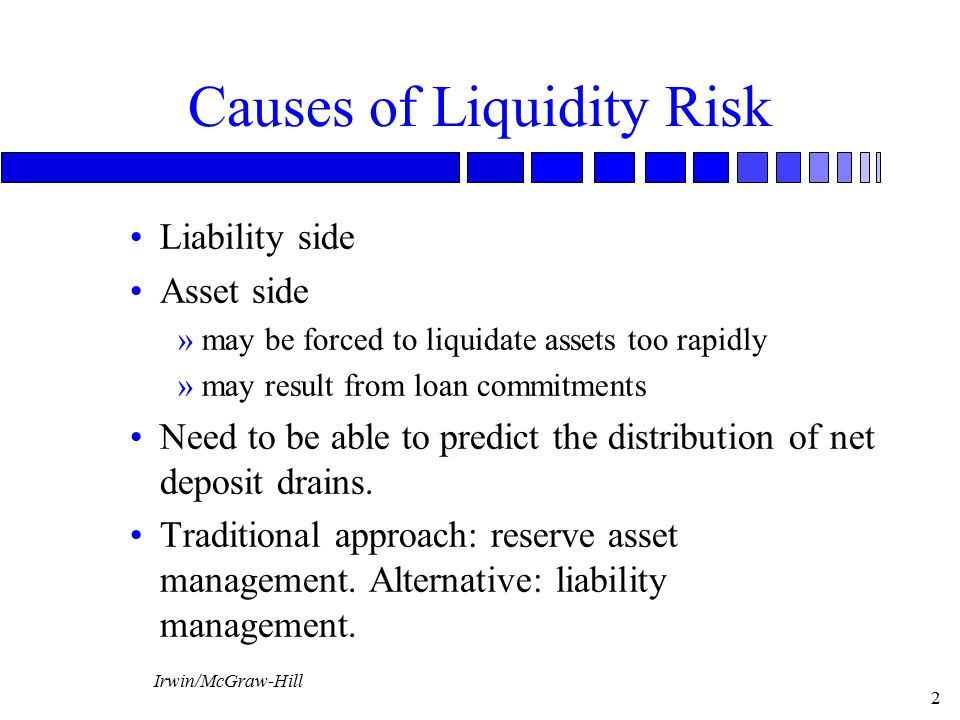

Deposits are most often used when there is a valuable asset provided for use to the buyer or renter, or to secure the full payment of a product or service being provided at a later date. A deposit provides an added level of security for the seller by creating a binding, often non-refundable agreement for full payment once the deposit money meaning sale is completed. A deposit is an amount of money paid by a buyer to a seller at the beginning of a sales process in order to secure the sale. This type of money is considered liquid as it is available without any delay. The first category means that the deposit that has been made by one party has been done as safekeeping.

Normally any money deposited to a bank becomes property of the bank, for which it is liable to return the same monetary value, but not the same money. This the foundation of fractional-reserve banking, since the bank can lend out the money that it owns while owing an obligation to the depositor. A special deposit is one made under an agreement to hold the deposit separately from the bank’s assets, so that the same assets can be returned. Items placed in a safe deposit box are examples of special deposits.

You must typically use a branch ATM or an ATM that your bank owns, but credit union members can often use other credit unions to make deposits if they participate in shared branching. A deposit is essentially your money that you transfer to another party, such as when you move funds into a checking account at a bank or credit union. When a person contributes or deposits money, then he will have to wait for a specific time until that amount can be withdrawn.

What’s the best savings account for building up a house deposit?.

Posted: Thu, 03 Aug 2023 05:00:59 GMT [source]

Entities such as brokerage firms require traders to make some deposits before they can enter into futures contracts. The initial deposit before delivery is required by certain contracts as a deed of fair dealing. Bank accounts that let you deposit and withdraw money are called deposit accounts. They can include checking, savings, and money market accounts, as well as CDs.

A deposit in finance is typically when you transfer money to a bank account like a checking account for safekeeping. For example, you may need to place a deposit, or a certain amount of money, with a business to secure goods or services such as for a rental. Many checking accounts do not provide interest, while most savings accounts and certificates of deposit (CDs) do.

It’s up to the discretion of the seller whether to require a deposit on their sales. For example, if a sale seems particularly risky due to large volume or other circumstances, a deposit might make the seller feel more comfortable continuing with the sale. If you want to pay in a large cash deposit your bank may ask you questions about where the money came from because of money laundering regulations.

But the plus point of such deposits is the higher interest rate. You’re usually required to pay a security deposit when you rent an apartment or use certain services. Your landlord or service provider holds that money in an account for safekeeping in case you cause damage to your rental or don’t make all your required payments. When you deposit money into some bank accounts, it can earn interest.

Your bank deposits are insured by the U.S. government in the event your bank fails. Most bank deposits are insured up to $250,000 per bank, per depositor. You must — there are over 200,000 words in our free online dictionary, but you are looking for one that’s only in the Merriam-Webster Unabridged Dictionary.

This transfer of funds means that the money is being stored or held in a bank account for a while. You can also transfer money from one bank account to another electronically, making a deposit into the receiving account. These deposits may be available immediately as well if both accounts are with the same bank, or if your bank uses a service like Zelle for money transfers. You must fill out a deposit slip when you deposit cash or checks. The slip tells the bank where you want to put the money, and it creates a record of the transaction. You must also endorse any checks you’re depositing by signing the backs and adding any additional information that’s required.

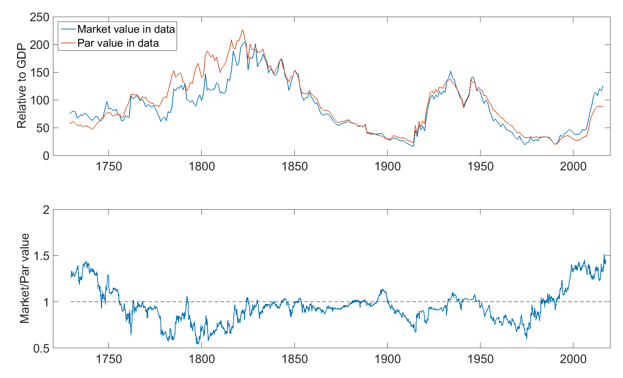

When the term period ends, account holders can either withdraw the funds or renew the deposit to be held for another term. A bank deposit with a fixed interest rate and term is called a time deposit. A person cannot withdraw money from a time deposit account for a fixed term or must pay a penalty should he/she need to withdraw funds before the term ends.

Just sign the check, add a few details, and submit a picture of both sides of the check to your bank. You can deposit funds into your account in several different ways. Add deposit money to one of your lists below, or create a new one. Mary deposited $200 to get the latest LCD for her room out of the total amount. Terry placed a deposit for one year at an annual rate of 4.5%.

Most banks will take deposits in the form of cash, checks, money orders, or cashier’s checks. If you’re using a check to open an account, there may be a holding period as the new bank ensures the check will clear. In the case of depositing money into a bank account, you can withdraw the money at any time, transfer it to another person’s account, or use it to make purchases.

A demand deposit is a type of deposit where a contributor can withdraw every single amount of money or asset without facing any penalty. This type of deposit provides additional outstanding liquidity and straightforward entry or easy access when it comes to the transfer and usage of the funds. Your checking account’s deposits are generally available “on demand,” which is why they’re sometimes called demand deposit accounts, transaction deposits, or current accounts. Often, you must deposit a certain amount of money, called the “minimum deposit,” to open a new bank account. Depositing money into a checking account qualifies as a transaction deposit, which means that the funds are immediately available and liquid, and you can withdraw them without delays. You can walk into a bank branch and hand cash or checks to a teller, who will then credit the funds to your account.

Deposits which are kept for any specific time period are called time deposit or often as term deposit. For one person to get his funds back, he must give a notification for the termination of the account. Then they can choose whether to keep the money or invest in another term deposit.

Such deposits, which are kept for some time, are known as time deposits. A cash deposit is the money you pay into your bank account or savings account. The bank then has a liability to keep the money safely and pay you it back on the terms you have agreed for that account. A deposit is the upfront payment made before the sale is completed. A down payment is an amount typically paid at the time of sale, which represents an initial amount while the rest is funded by a loan or, in the case of property, a mortgage.