Intrinsicly evisculate emerging cutting edge scenarios redefine future-proof e-markets demand line

Gallery Posts

Working Hours

| Mone - Fri: | 09:00 - 06:00 |

|---|---|

| Saturday: | 09:00 - 12:00 |

| Sunnday | 09:00 - 04:00 |

| Monday | 09:00 - 05:00 |

The repainting and renewal of older assets are accounted for under revenue expenditure. The company incurs it in connection to the acquisition of capital assets for using them to generate revenue over a long period. Capital expenditures are usually recorded within one of the major fixed asset classifications.

In other words, the expenses reduce profit from a tax standpoint, and thus, reduce the taxable income for the tax period. Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed. Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed. In this article, we’ll take a closer look at the expenditure definition for revenue vs capital expenditure, diving further into what separates them. Find out when to hire a new Edmonton accountant for your business’s financial well-being. In the case of certain capital receipts, there are future obligations to return the amount along with interest.

Typically, a business incurs expenditure to increase its efficiency and further returns. Business expenditures are categorized into capital and revenue expenditure. Forgot that maintenance costs aren’t factored into the capital expenditures on those new industrial printers? That’s a hole developing in your pocket all of a sudden—it’s a revenue expenditure. Thinking of billing your advertising costs at the end of your yearlong cycle?

If the asset is one that will depreciate in value, such as a vehicle, the expense is usually logged over the life cycle. If the asset will remain in the same condition, such as software, the expense is logged all at once. Revenue Expenditure refers to the estimated expenditure of the government in a fiscal year that does not affect the assets and liabilities status of the government.

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Revenue and Capital Account are the two main accounts of the government. It is a Capital Expenditure as it reduces the liability of the government. Classify the following expenditures as Revenue Expenditure and Capital Expenditure.

A revenue expenditure is an amount that is spent for an expense that will be matched immediately with the revenues reported on the current period’s income statement. When your company purchases a storage area, it’s recorded as a capital asset in the balance sheet. All the painting and refurbishing do not add to the revenue-generating capacity of the asset. They typically are not in charge of creating or enhancing a company’s ability to make money. Regardless, they are essential for generating revenue within a specific accounting period and play a significant part in managing operational activities and assets more effectively.

Capital receipts are those that create liability or reduce an asset, while revenue receipts neither reduce nor generate liability for the company. Revenue expenditure, also called operating expenditure, is typically a transient expenditure consumed inside the ongoing time frame or soon. All maintenance and routine support and repainting and recharging costs are income costs related to existing resources. This article explains the capital and revenue expenditure and the main differences with examples. But now it can also come in digital form such as cryptocurrency and shares.

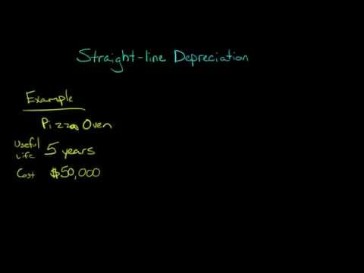

They are related to regular operations, i.e. the ordinary course of business. Capital expenditures are charged to expense gradually via depreciation, and over a long period of time. Depending on the asset, depreciation charges could extend out for more than a decade. Revenue expenditures are charged to expense in the current period, or shortly thereafter. Capital and revenue expenditures are not the same, despite both involving company expenses. The similar meanings of both expenditures cause many to mix them up, failing to see the important differences.

Capital expenditure and revenue expenditure are significant to a business. Capital expenses are shown as assets on the Balance sheet and in certain parts of the income statement, and revenue expenses are always mentioned in the income statements. If the technology, computer equipment, and peripherals fall into the specified criteria, they, too, will come under capital expenses. Usually, such equipment has a lifespan of more than a year if not, it will not be considered capital expenditure. These expenses are recurring in nature and are to be settled regularly. As they are subtracted from the revenue generated amount, the total taxable income of the business decreases.

Bankrupt CFDs Broker: City Credit Capital Lost £10M Professional Traders Funds.

Posted: Tue, 05 Sep 2023 08:08:12 GMT [source]

Capital expenditures represent significant investments of capital that a company makes to maintain or, more often, to expand its business and generate additional profits. Capital expenditures consist of the purchase of long-term assets, which are assets that last for more than one year but typically have a useful life of many years. Capital expenditures belong on the balance sheet and get expensed gradually with depreciation; some can last as long as a decade. On the other hand, expense revenues are short-term and expensed fully within the same accounting period. Capital expenditure is not to be confused with operating expenses which are short-term expenses needed to operate a business.

Capital expenditure involves huge costs as the value of assets and investments are large amounts. A transaction is only classified as capital expenditure if it crosses a certain limit. It differs from organization to organization to classify what expense what are the tax brackets will be capital or revenue. Capital expenditures are expenses incurred by a company for the long term benefit of the company. By enhancing or adding new assets to the organisation, these expenditures increase the capacity of a long-term investment.

Revenue expenditures are ongoing operating expenses that are short-term expenses used to run a business’s daily operations. They generally account for resources like land, gear, goods, or vehicles that expand a company’s working capacity. The basic difference between capital expenses and revenue expenses is whether they are long-term or short-term investments. Capital expenditure (CapEx) is incurred by a company to acquire physical and intangible assets like property, machinery, equipment, patents, copyrights, and others. Revenue expenditures on the other hand are for a short period and recurrent in nature. They are not capitalised and involve maintenance of equipment and machinery, rent, salary/ wages, and others.

Therefore, if any property provides long-term benefits to a company, the purchase of this property by the company will be recorded as a capital expenditure. On the other hand, revenue expenditures are for a short duration during the current period. They include ongoing operational costs for running a business such as rent, business travel, salaries, etc. Capital expenditures are large, one-time purchases of fixed assets that will be used to generate revenue over a longer time.